Boost Your Gold ETFs With These Tips

페이지 정보

작성자 Shoshana 작성일25-01-05 10:16 조회10회 댓글0건본문

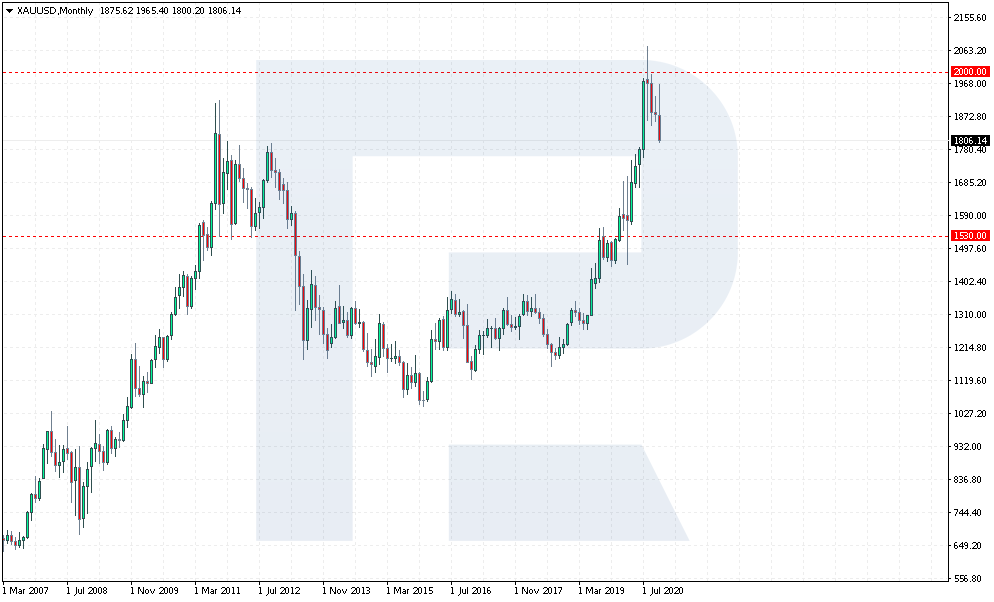

Once we consider diversifying our investment portfolio, it's vital to include various asset courses to steadiness threat and reward successfully. We’ll cover the 100% stocks portfolio, the 60/40 portfolio, and eventually the All Weather portfolio. In case you lose all other stocks in a crash, your gold ought to follow historical tendencies and go up in value, keeping you from dropping all the things. Volume should be thought of in live performance with share worth to essentially see development tendencies. GLD's affect on the gold world has already been big in its preliminary three years, and it will only develop as GLD becomes extra extensively identified as the premier method for American inventory capital to sport the gold worth. But this uncooked share-quantity growth actually understates GLD's trading impact. Then in February 2006 gold began consolidating, but interestingly GLD's holdings remained stable. GLD holdings were pretty stable throughout this parabola, indicating that its own supply/demand profile matched that of gold's closely.

And as gold drifted decrease following a bounce after that mid-2006 crash, GLD holdings had been stable and even grew modestly. So GLD and the other gold ETFs will increasingly contribute to gold volatility as their holdings develop. There are even two gold ETFs on our platform that you could invest in fee free. Assuming 7m is now average today, and GLD is buying and selling close to $eighty per share, we are talking about $560m in capital quantity. And despite GLD's massive gold holdings, it is still vanishingly small in comparison with stock-market capital. Pick a quantity, but I'd wager that at least 80% of GLD's run increased was pushed by non-conventional gold investors. Shunting stock traders' capital into physical gold by way of ETFs is a really, very good thing for all gold investors. I and Capital Coins Ltd. Gold coins had been first minted in 550 B.C.E. So the custodians once again shunted this stock demand into bodily gold by adding extra bullion.

And as gold drifted decrease following a bounce after that mid-2006 crash, GLD holdings had been stable and even grew modestly. So GLD and the other gold ETFs will increasingly contribute to gold volatility as their holdings develop. There are even two gold ETFs on our platform that you could invest in fee free. Assuming 7m is now average today, and GLD is buying and selling close to $eighty per share, we are talking about $560m in capital quantity. And despite GLD's massive gold holdings, it is still vanishingly small in comparison with stock-market capital. Pick a quantity, but I'd wager that at least 80% of GLD's run increased was pushed by non-conventional gold investors. Shunting stock traders' capital into physical gold by way of ETFs is a really, very good thing for all gold investors. I and Capital Coins Ltd. Gold coins had been first minted in 550 B.C.E. So the custodians once again shunted this stock demand into bodily gold by adding extra bullion.

Gold has been gaining in worth for 10 years - and it has at the least 7-9 (and maybe many more) years to go. If GLD didn't equalize inventory demand into bodily this fashion, soon its worth would decouple from gold's to the upside. The ETF custodians had to equalize this excess inventory demand into gold by shopping for more bullion. That is all of the extra exceptional considering gold was consolidating for over half of this period. Selling your Spanish collectible at its melt value would result in a loss of over 90%. Not exactly what you signed up for when investing in the "safety" of gold. The case for holding gold is excessive on this case; it’s a scarce asset with no counter celebration risk that holds its buying power over the long term, and is competing with Treasuries and financial institution accounts around the world in multiple currencies that pay unfavorable actual yields. Lack of capital signifies the importance of implementing financial asset protection methods to preserve wealth, ensure investment security, maintain capital preservation, and foster sustainable investment progress. Whenever an asset grows more widespread, which is virtually inevitable the longer a price rises on stability, trading volume will increase. What factors influence the value of gold?

By following the following pointers, you possibly can ensure that you simply get the very best value for your money when purchasing your gram of 14K gold. Unless you're an professional at removing asbestos or wiring electricity, it is best left to the professionals. Without rising costs, traders often regularly exit a market and search for سعر الذهب في الكويت greener fields elsewhere. And whereas we did see this to some extent in GLD, its quantity waned a bit throughout consolidations, it was still rising on stability. While the laws of economics could be defied within the short time period, history demonstrates that traders ignore them at their peril. This conservative estimate works out to 480t. So due to the mere existence of this flagship gold ETF, somewhere between 480t to 600t of gold made it into the portfolios of American stock traders that probably would not have otherwise. Since many present gold-coin buyers nonetheless view this "paper gold" with disdain and suspicion, I do not think it was conventional gold capital that bid GLD up to 600t of usd gold price. And now, three years after its launch, GLD has soared to the staggering 600t mark. And the fact that GLD's holdings have spent three years rising on balance regardless if gold is soaring, sinking, or drifting is extremely bullish.

If you have any kind of questions concerning where and just how to make use of سعر الذهب في الكويت, you can contact us at the web page.

댓글목록

등록된 댓글이 없습니다.