Top Ten Ways To buy A Used Gold Price Today

페이지 정보

작성자 Trisha 작성일25-01-06 05:14 조회4회 댓글0건본문

Evaluation of fund performance- It's important to maintain a verify on the fund's observe document out there. Total Market Index, ETFs that track the S&P 500, which are issued by The Vanguard Group (VOO), iShares (IVV), and State Street Corporation (SPY), ETFs that observe the NASDAQ-100 index (Nasdaq: QQQ), and the iShares Russell 2000 ETF (IWM), which tracks the Russell 2000 Index, completely composed of corporations with small market capitalizations. 7. Low-value gold-backed ETFs are outlined by the World Gold Council as alternate-traded open-ended funds listed within the US and Europe, backed by bodily gold, with annual administration charges and different expenses like FX costs of 20bps or less. When you've got moves whether or not or not you show these moves on the basketball court or in life, you're like butter. Federal Reserve, have made non-yielding belongings like gold more enticing. Yet, the strain is on to reduce costs, so as to return more on to stakeholders. This situation, according to Harper, describes an inexpensive return.

Evaluation of fund performance- It's important to maintain a verify on the fund's observe document out there. Total Market Index, ETFs that track the S&P 500, which are issued by The Vanguard Group (VOO), iShares (IVV), and State Street Corporation (SPY), ETFs that observe the NASDAQ-100 index (Nasdaq: QQQ), and the iShares Russell 2000 ETF (IWM), which tracks the Russell 2000 Index, completely composed of corporations with small market capitalizations. 7. Low-value gold-backed ETFs are outlined by the World Gold Council as alternate-traded open-ended funds listed within the US and Europe, backed by bodily gold, with annual administration charges and different expenses like FX costs of 20bps or less. When you've got moves whether or not or not you show these moves on the basketball court or in life, you're like butter. Federal Reserve, have made non-yielding belongings like gold more enticing. Yet, the strain is on to reduce costs, so as to return more on to stakeholders. This situation, according to Harper, describes an inexpensive return.

Such a method ought to satisfy with acceptance by the silver males, because they're, I think, universally fond of asserting that for a whole lot of years the "bimetallic normal" provided a good forex, free from all objections, and that our nice object is to reverse the present of events and return to the follow of the previous, from which the nations have one after the other sadly departed. The next securities talked about in the article had been held by one or more accounts managed by U.S. Additionally, many need a minimum of withdrawals when you reach a certain age and more. Hence, we don’t think central bank purchases can clarify the current big discrepancy between predicted and observed prices. However, we have now had years with giant central financial institution purchases before, and we had years with larger total gold demand from all sectors, and yet this didn’t lead to massive distortions in our mannequin.

Therefore, in our view, the one motive for gold costs to detach from the underlying variables in our model by such a big quantity and for such a long time is that the gold market finally starts pricing in that there is a risk central banks, particularly the Fed, are dropping control over inflation, which is remarkable given the prevailing narrative that the Fed is prepared and able to do no matter it takes to deliver inflation underneath control. In our models, we use publicly accessible data for internet central bank sales/purchases. The official information from the IMF is notoriously lagging and incomplete, and we're sure that the reported web buy numbers are a lot too low. But exactly how much gold they added stays a bit of a thriller. So you may need to settle for selling your holdings for a lot lower than they may otherwise command on a nationwide market. We'll clarify why to date it was comparatively simple for the Fed to raise charges, why this is about to change and why the gold market could certainly price in a shift in paradigm.

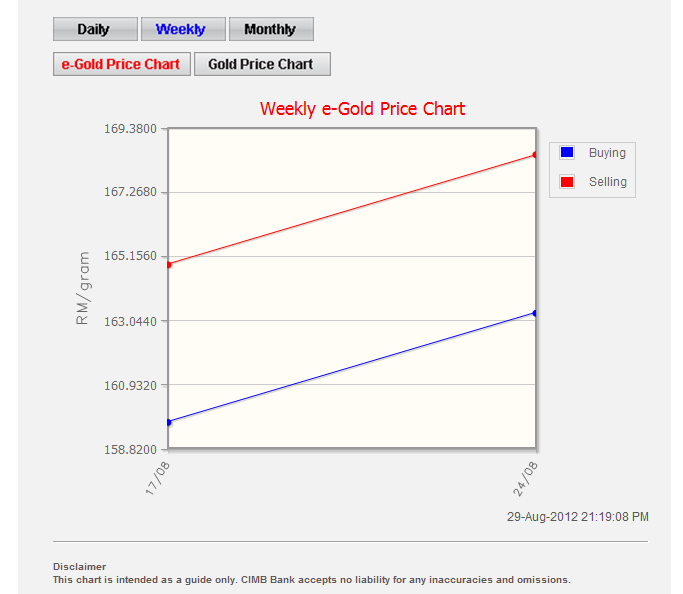

Currency fluctuations play a major position in determining the worth of gold in Malaysia. Which means the actual worth of the currency declines. This provides to an investor’s diversification of proudly owning a gold product and one in a forex aside from the greenback. This commentary should not be considered a solicitation or offering of any funding product. The Malaysian authorities has demonstrated its assist for gold investment by implementing various initiatives. A weaker Malaysian Ringgit relative to the US dollar can result in larger gold prices in Malaysia. Gold prices are heavily influenced by world economic conditions. From its historic significance to its potential for diversification and wealth preservation, there are plenty of reasons why gold funding is gaining recognition in Malaysia. It's broadly considered a retailer of value and an emblem of wealth. Because of this the purchasing energy of your funding in gold may enhance over time, allowing you to keep up your wealth and purchasing potential. Although dwelling storage may seem convenient, it exposes our assets to risks corresponding to theft or injury. Each option has its benefits and considerations, depending on elements similar to comfort, liquidity, and storage necessities.

If you have any type of inquiries regarding where and how to make use of gold price today (wallhaven.cc), you could call us at the web site.

댓글목록

등록된 댓글이 없습니다.